Links for Tax Credits and Programs

Canadian Disability Tax Credit

A program from the Government of Canada

From their website: "The disability tax credit (DTC) is a non-refundable tax credit that helps people with disabilities, or their supporting family member, reduce the amount of income tax they may have to pay."

For mental functions (e.g., psychological conditions, such as autism and ADHD), psychologists and medical doctors can complete Part B of the form. You can send in a paper copy or submit digitally through CRA

Website: Click here

Canadian Disability Tax Benefit

A program from the Government of Canada. If you receive the DTC (above), check your eligibility for the Disability Tax Benefit

From their website: "The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old. The program is administered by Service Canada."

Website: Click here

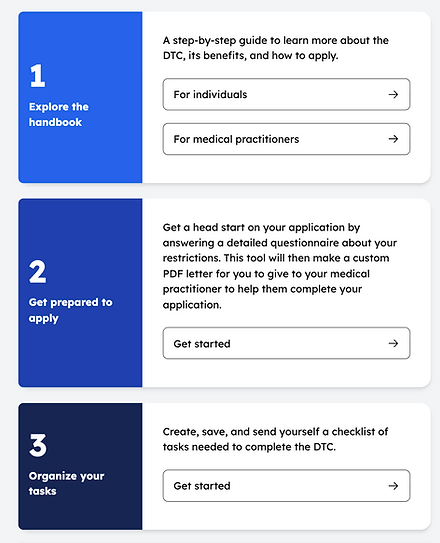

Support with your Application for the Disability Tax Credit

Disability Alliance BC has developed a web tool to help Canadians apply for the DTC (above)

Disability Alliance BC has developed a web tool to help Canadians apply for the DTC (above)

From their website: "My DTC is a guide to the Canadian Disability Tax Credit. It has info on benefits, eligibility, and the overall process, as well as some tools to help with applying."

The tool allows you to go through the sections of the DTC form to provide details that your medical professional can use when completing Part B

Website: Click here

Thanks to one of my clients who used this tool to send me helpful information to complete Part B and to introduce me to this website

Guide for Psychologists found here

Disability Alliance BC Website